Most people need to save and invest a portion of their earnings over a long period of time if they want to retire someday. The goal is for this money to grow and provide you with future income. Although investing includes risk because you can lose your money, it also has the potential for strong returns which is what you need to build up your retirement nest egg. For many investors, the process of investing can be very intimidating because of the huge number of investment options available plus all the financial ratios and statistics that are provided for each one. You can invest in individual stocks, mutual funds, and exchange traded funds in a variety of asset classes and sectors. So how does someone get started trying to figure out how to invest their hard-earned money? The following are some do’s and don’ts of investing to help you with that.

Do your homework and don’t invest based on headlines

One of the first things you should do is to educate yourself on basic investing topics. There are many resources available online explaining concepts such as risk, returns, interest, and different types of investments. One mistake many investors make is basing investment decisions on news headlines. Articles are published every day with analysts predicting what direction the market is headed or what the next hot stock is going to be. I routinely see articles predicting a coming bull market, and another article on the same day claiming the market is about to suffer a major crash. It is best to ignore these types of writings with wild predictions. Instead, do your homework, only read news about the market from reliable sources, and keep your focus on the long-term.

Design your portfolio to be globally diversified and don’t try to time the market

Diversification starts by dividing your portfolio into stocks and bonds, which should be based on your risk tolerance and retirement timeline. From there it is further divided by investing in various asset classes such as large and small cap stocks and international stocks and bonds. This diversification process is the best way to ensure that whatever segment of the market is performing best, you will be benefiting from it. On the flipside, if there is a segment not doing so well it also ensures you are not invested too heavily in that area. By being diversified there is no need to engage in trying to time the market, which is generally a losing strategy. Sometimes you may get lucky, but it is just too difficult to accurately guess which areas of the market are going to perform well at any given time.

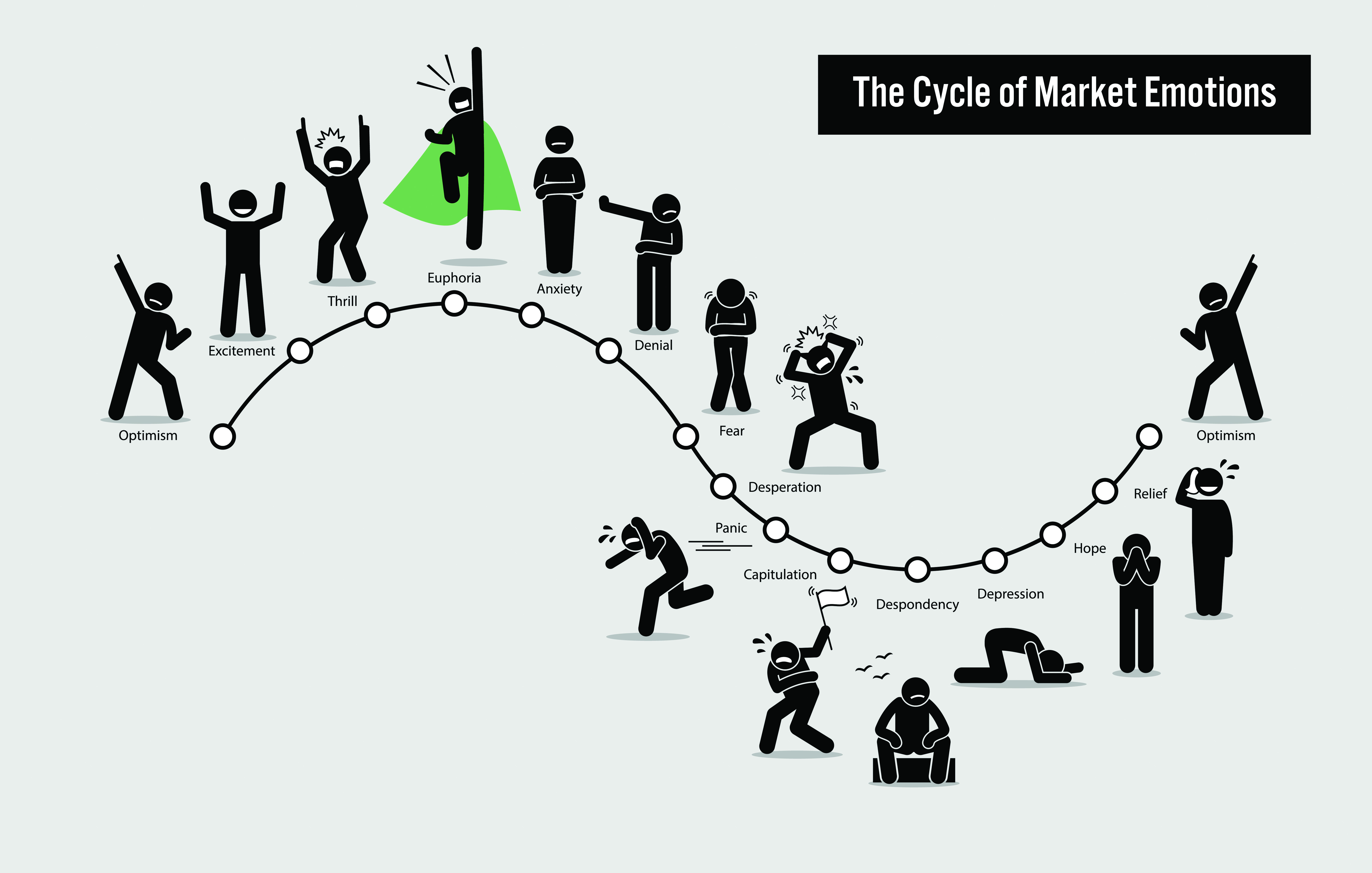

Be patient during times of volatility and don’t invest emotionally

The year 2020 was a good example of how volatile the market can be. The roller coaster of the March crash and the ensuing recovery for the remainder of the year certainly caused emotions to run amock. It is easy to allow your emotions to take control and cause you to make knee-jerk decisions about your portfolio. During times like these it is best to be patient and let the market do its job. Since 1926, there have been numerous ups and downs in the market, but it has consistently produced strong returns. If your portfolio is properly diversified with the appropriate amount of stock and bonds you should be in a good place to handle market volatility. Staying the course is perfectly acceptable or some may take the opportunity during a down period to increase stock. Whatever you decide, don’t panic, and make sure the decision is well thought out and is not made as an emotional reaction.

Pay attention to expenses and taxes

It is important to pay attention to fees when you are investing. Not all funds are created equal and higher fees mean less returns for you. When investing in funds, there are two different types to consider – actively managed and passively managed. Actively managed funds strive to beat the market and have much higher fees associated with them. What many investors don’t know is that most actively managed funds fail to beat the market. Passive funds strive to match a specific index such as the S&P 500 and have very low fees. In addition, if you have accounts that have different tax consequences, pay attention to which account you are placing your investments. Certain investments are more suitable to specific accounts and can cost or save you taxes.

Review your portfolio every 6 – 12 weeks and don’t watch it daily

A good rule of thumb is to review your portfolio every 6 – 12 weeks and it is okay to just forget about it in between. If your portfolio is properly allocated between the asset classes and is globally diversified, there is no need to be watching it daily. During your portfolio review, check to see if your asset classes and stock to bond percentages have drifted from your desired allocation. If they have drifted too far, perform re-balancing as necessary keeping taxes in consideration and checking for opportunities to take tax-deductible losses in taxable accounts.

Focus on what you can control

When it comes to investing, there is so much out of our control which is why it is easy to get caught up with the latest hot investment tip or make emotional decisions based on what is happening in the market. It is best to focus your energy on the things you can control like making sure your portfolio is globally diversified, expenses are kept to a minimum, taxes are taken into consideration, and you are invested across a broad range of asset classes.

Deborah Hobart, CPA is a Financial Advisor at Blue Water Capital Management, LLC, a fee-only financial advisory firm in Apex, NC. For more from Deborah, check out Blue Water’s latest Investing Insights on their website.