To achieve your financial security, and that of your family, you will need to create a comprehensive strategy. But for this strategy to succeed, you’ll need to guard it from various challeng... Read more

One of the rewards for working over several decades is the ability to contribute to tax-advantaged retirement accounts, which can help provide needed income for you when you do retire. As th... Read more

As you know, inflation was big news throughout 2022. But will it continue in 2023? And looking even further ahead, how should you account for inflation in your long-term plans? In regard to... Read more

When it comes to investing, there are many different strategies to use. One popular strategy is investing for dividend income. This strategy is especially popular with retirees because it pr... Read more

I work with people of all ages, income levels, retirement timelines, and goals. There is one commonality though, and that is everyone wants to save enough so they will not run out of money d... Read more

Inflation has been very low and stable for the last 50 years, but the recent rise in consumer prices has many predicting that we are entering a period of inflation. The last time we experien... Read more

If you have spent any time reading about the principles of investing, you have undoubtedly come across the concept of diversification. We are all familiar with the adage of “not putting all... Read more

Income taxes are one of the biggest expenses we incur. We try to minimize the amount owed by looking for ways to reduce our taxable income. During our working years it is important to strike... Read more

Interest rates have been at historical low levels and even with the recent increases, the 10-year treasury yield is still only at around 1.65% as of this writing. With rates at this level an... Read more

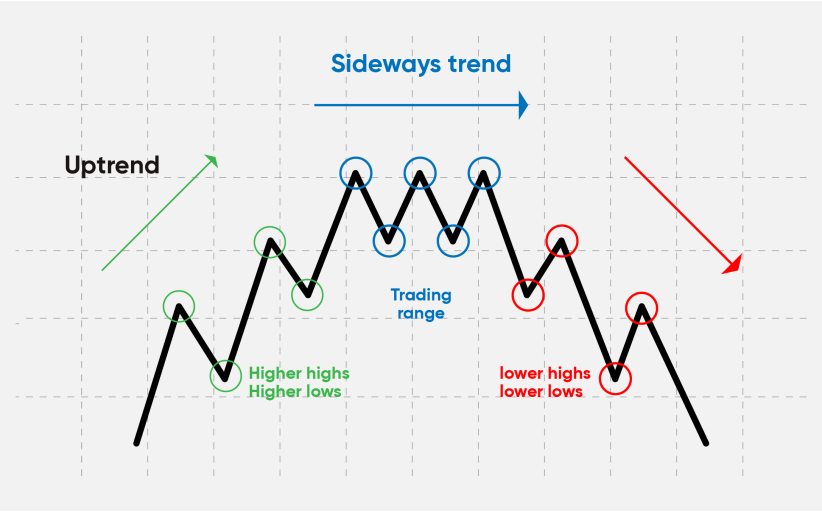

As investors, we all know we are accepting some level of risk when we put money into the stock market. Some of us struggle with the market ups and downs and wonder if there is any way to red... Read more