It’s the million-dollar question everyone is asking: What can we expect from the Triangle real estate market in 2022? Unfortunately, no one has “the answer,” but by analyzing the past few years and the first quarter of 2022, we can better predict what’s to come and plan a winning strategy for navigating the market.

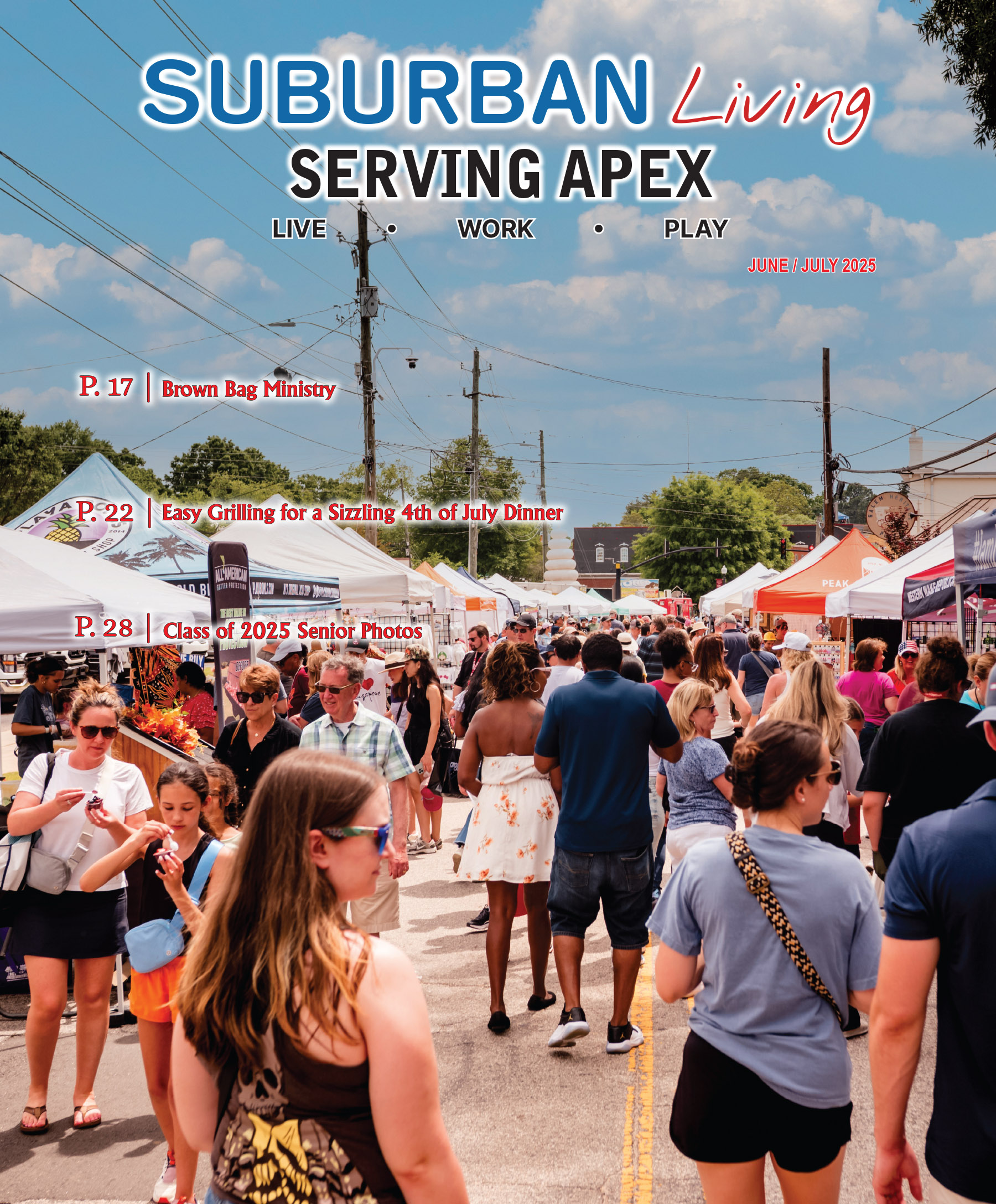

If you haven’t heard, the Triangle was named the No. 2 “Best Place to Live” for 2021-2022 by US News & World Report, and we were ranked No. 2 in “Top States for Business” in 2021 by CNBC. Our beloved Apex, voted the No. 1 “Fastest Growing Suburb” in the country by Realtor.com, has quickly become one of the most competitive areas in town amongst both newcomers and local residents looking to change their zip code.

It’s easy to see why the Triangle is an attractive place to live. Our proximity to beaches and mountains, dense concentration of universities and hospital systems, diverse arts and cultural scene, and innovative food and beverage options barely scratch the surface of what our region has to offer. Add to that the Research Triangle Park (RTP) and excellent job opportunities, and there are plenty of reasons to put down roots in the Triangle.

All things considered, it’s obvious as to why the Triangle’s real estate market has become red hot. Raleigh’s population is one of the fastest growing in the country, and the demand for homes shows no signs of slowing. We’re in a conundrum—all the features that make our great state so appealing have led to competition and price increases that are making some buyers wary.

Nationwide, we are seeing double-digit appreciation levels because of low inventory and high buyer demand, with investors and iBuyers creating additional distraction. But despite these challenges, one thing remains clear: real estate is one of the best investments you can make in your lifetime!

Are you thinking about buying or selling this year? Here are a few insider insights to help you get ahead in this market:

Homeowners: Market values have gone up, and so has your equity. Existing home sales in 2021 reached their highest levels since 2006, according to the National Association of Realtors. North Carolina homeowners gained an average of $54,000 in equity from 2020 to 2021, approaching the national average of $56,000. Home values have continued to rise since 2021, which means your equity has continued to grow as well. In the Triangle region, 2022 will remain a seller’s market. Being realistic with listing pricing, even in this climate where it seems sellers can “name their price,” will be the key to selling quickly and getting top dollar for your home. Homes that are priced well and are move-in ready will fetch the highest and best bids.

Buyers: Stay ready so you don’t have to get ready! What does “stay ready” mean? Whether you’re a first-time homebuyer or gearing up to purchase your fifth home, the first step in the process is getting pre-approved with a local lender who understands your market. A full pre-approval (not pre-qualification) will allow you to not only better understand your budget as you’re searching for homes, but it will signal to the listing agent that you’re serious about the home you want to purchase and you have the funds to back up your offer. Plus, you’ll be hard-pressed to find a listing where the agent isn’t asking for your pre-approval letter or proof of funds attached to the offer. This is the best way to protect a seller and make sure the transaction is closed!

Inflation is up, and so are the interest rates. There will be a cost for waiting to buy or becoming active in the market. Conversations with buyers and sellers alike typically include phrases like, “We’ll get started when things cool off,” but the fact is, the Triangle market is showing no signs of cooling off this year. Home appreciation and the potential for multiple hikes in interest rates this year will only cost you more down the road. Don’t hesitate to get your ducks in a row today.

Rent is on the rise. Rental prices in Raleigh have increased more than 20% during the past few years (with the pandemic fueling some of the appreciation), and the Triangle area is above the state and national averages. Unfortunately, rents are continuing to rise and many renters believe they will never be able to save enough to buy. First-time home buyers have always been told they must “put 20% down” in order to own property, which could not be more untrue. Working with a local lender to find the type of mortgage loan that works best for a first-time buyer (dependent on their individual income and financial situation) is the key to finding a home, even in this competitive market and even with down payments as low as 3%.

Work with someone you trust. Bottom line, whether you’re buying, selling, or relocating in 2022, it is in your best interest to hire a trusted advisor to lead you through the process. If you don’t have someone on your side to advocate for you, update you on market trends and expectations, speak with other agents and negotiate terms, or simply keep the transaction on course to get to the closing table on time, then you’re automatically at a disadvantage in this competitive market. Keep in mind: the average home in 2021 had roughly five offers, so you’re going to need support from a successful agent who knows the market inside and out, whether you’re fielding the offers or submitting them.

Our real estate market can be challenging, but don’t be afraid to hire an agent you trust and jump in. One thing’s for sure, there’s never been a better time to call the Triangle home.

Danni Dichito is a North Carolina Realtor® with Allen Tate Realtors, the No. 1 real estate company in the Carolinas. Danni makes her home in Apex and serves clients throughout the Triangle and beyond.